Autism Plus

Autism Plus supports adults and young people with autism, learning disabilities, mental health conditions and complex needs. They attract referrals from local governments and Clinical Commissioning Groups on a case-by-case basis. Autism Plus employ over 450 people across the north of England in care support services, employment support and social enterprises.

3SC Capitalise

3SC Capitalise is a Social Impact Bond working with young people in Wales. It is part of the Department for Work and Pensions' Innovation Fund.

Acorn Early Years Foundation

With now 13 nurseries across 3 countries, the Acorn Early Years Foundation continues to grow it's mission in inspiring and leading the early childhood sector.

Adviza

Energise is a Social Impact Bond working with young people in the Thames Valley area. It is part of the Department for Work and Pensions' Innovation Fund.

Alternatives Activity Centre

Established in 1990, Alternatives Activity Centre (AAC) is a registered charity that provides support for adults with learning disabilities in the city of Derby, in the form of an activity-based day centre, a training shop (which offers training workshops as well placements within their own charity shop) and community support.

Ambition Community Energy

Ambition Community Energy (ACE), is a Bristol-based social enterprise generating clean, affordable energy, run by the people of Lawrence Weston.

Ambition East Midlands

Ambition East Midlands is a Social Impact Bond working with young homeless people in the East Midlands.

Aspire Gloucestershire

Ambition East Midlands is a Social Impact Bond working with young homeless people in Gloucestershire.

Barnsley Community Build

Barnsley Community Build (BCB) is a registered charity with a trading arm, BCB Trading Ltd. They develop and deliver a range of community services, and provide employment and training in the construction industry.

Bemix CIC

We are a CIC based in Kent, supporting people with learning difficulties to speak up, make choices and become powerful and influential. We are people with and without learning difficulties and/or autism, working and learning together.

Beverley Tree Community Centre

Beverley Cherry Tree Community Centre is a charity based in East Yorkshire. Located on the Cherry Tree Estate, it works with those in the community struggling with varying degrees of poverty.

Blackburne House

Blackburne House is a Liverpool-based charity that supports the development of local - and often vulnerable - women. With a core focus on education, they offer a range of nationally-recognised courses and qualifications to women - particularly in sectors in which women are still under-represented.

Book of You

Book of You acts as a reminiscence therapy, to help people living with dementia to connect to their memories but soon realised that we could help all sorts of people, including older people living in assisted accommodation and young adults with learning disabilities. They've now developed a digital story book helps the user to build a familiar picture and story of someone’s life, filled with precious life events and memories.

BS3 Community

The Chessel Centre will offer additional quality nursery care for children in Bristol.

Burley Gate Community Shop and Post Office

Burley Gate Community Shop raised money from the local community using Social Investment Tax Relief.

Cafe van Gogh

Café van Gogh is a restaurant with a social and environmental mission in Brixton. Apart from serving delicious vegan and seasonally changing food, the restaurant also provides employment and training opportunities for people additional needs, like learning disabilities and mental health challenges.

Câr-Y-Môr

A community owned business using regenerative ocean farming, food security and sustainable job creation to improve both the coastal environment and the well-being of the local community.

Caramel Rock

Our Digital Marketing Officer Festus spoke with the creative Faith Johnson who founded Caramel Rock. In this podcast we talk about her social enterprise supporting young and vulnerable people in London through fashion and employability. We look into the importance of lived experience but also how Faith valued inexperience when it came to turning her idea.. into a reality.

Cardboard Citizens

We were delighted to hear from Geetha Rabindrakumar, Director of Social Change at charity Cardboard Citizens. Listen to this podcast as part of our #AChangingWorld series and we explore how social investment has affected organisations during the lockdown and the opportunities it could now present.

Carrick Greengrocers

Carrick Greengrocers is a community-owned greengrocer established by people who live in, work in, or are otherwise passionate about Carrickfergus, Northern Ireland. They aim to trade in a way that supports a sustainable environment and economy and all profits are directed back into the business and local initiatives.

Central YMCA

Central YMCA is the world’s first YMCA, established in 1844, and a leading UK education, health and wellbeing charity. Their work includes creating alternatives to traditional education such as apprenticeships and study programmes, training fitness professionals who inspire communities, developing qualifications through an awarding organisation and helping people improve their health and wellbeing through the largest gym in central London.

Chocolate Films

Chocolate films is an independent, full-service video production company. They are an international agency based in London and Glasgow, with global partners and satellite offices in the EU and US. They make content with impact – from promo videos to documentaries, animations to event films, and more.

Circus Strong

Circus Strong is a community organisation dedicated to providing friendly, judgment free aerial circus and fitness classes. They especially welcome the LGBTQ+ community and individuals who suffer from depression, loneliness and anxiety.

Clevedon Pier

Clevedon Pier Heritage and Limited Trust is a Community Benefit Society which raised money via Social Investment Tax Relief (SITR) to help renovate and sustain Clevedon Pier.

Collaborative Women

Collaborative Women comprises CW Housing and CW Community. It was founded to address gender-based inequalities experienced by women in Trafford which lead to isolation, poverty and life limiting/life-threatening circumstances.

Commonweal Housing

Commonweal Housing used social investment to buy properties to support an innovative new project for formerly homeless people.

Community Campus 87

Community Campus 87 is a Community Benefit Society based in Tees Valley, Middlesbrough. We provide affordable housing, emotional & practical support, & training opportunities to over 200 people each week.

Contento Social Homes

Contento Social Homes exists to improve the support for survivors of domestic abuse and their children by providing safe accommodation and skills to improve their wellbeing.

Cornerstone Place

Cornerstone Place is a social enterprise which supports homelessness charities to add fit-for-purpose properties to their portfolios. Our unique ‘Shared Upsides’ model transfers more than 50% of the value in our project to our charity partners.

Corsham Gymnastics Academy

Corsham Gymnastics Academy (CGA) is an established gymnastics club based in Wiltshire. The club offers programmes that are inclusive to all from baby gym, pre-school, recreational and disability gymnastics which provide the opportunity for everyone to learn gymnastics.

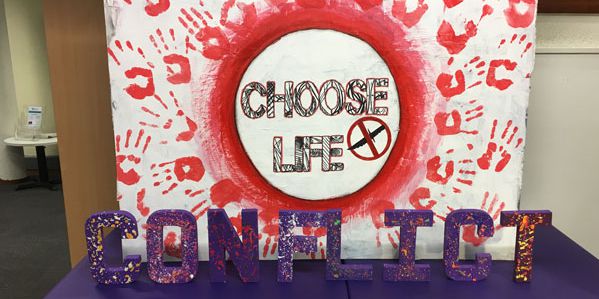

Creative Optimistic Visions

Creative Optimistic Visions (COV) is an award-winning Community Interest Company providing alternative education, training, universal youth provision, consultancy and mentoring services through the lens of the Protective Behaviours Process (PBs)

Doncaster Refurnish

Doncaster Refurnish complete a wide range of work, collecting, restoring and selling furniture on to low income families. They run a handyman service and a women’s group with a focus on anxiety issues. They also offer training and employment to those on the margins of their local community; including rehabilitation and integration opportunities for prisoners due for release, and placements for young offenders.

East Belfast Mission

Hosford is the homeless service of East Belfast Mission (EBM) based in the Skainos Centre on the Lower Newtownards Road in East Belfast, and for over 20 years, Hosford has provided services to people who are homeless or at risk of homelessness.

East Street Arts

East Street Arts (ESA) was established in 1993 when two artists couldn't find the support and infrastructure they needed to develop their art practice. ESA have worked to secure better livelihoods for artists and their neighbours and address issues of economic and commercial decline in towns and cities.

Ecodynamic

Local residents in Redruth funded the building of a wind turbine through buying community shares.

Egni Co-op

Egni Co-operative was established in 2013 and provides rooftop solar on schools, businesses and community buildings. It has installed solar panels on almost 100 sites across Wales.

Eidgah Academy CIC

Located at the heart of Perry Barr, Birmingham, Eidgah Academy is a community hub providing educational, recreational and social activities for economically disadvantaged children and young people. In Perry Barr, 60% of the population belongs to people from ethnic minority groups and 15% of the populations first language is not English. Eidgah Academy engages 130 predominately Muslim children and young people of Pakistani, Bengali and African backgrounds with opportunities through structured personal development programs and playing games.

Empower Community Foundation

Empower Community is a social enterprise that balances the interests of all stakeholders by developing projects that benefit all participants while providing high-quality, risk-mitigated investment opportunities.

Estuary Homes CIC

Estuary Homes was created in early 2017 to enable the three partner organisations (Foresight, Preston Road Women’s Centre and CERT) to pursue their objective of offering safe accommodation to vulnerable groups locally in Humberside.

Fair for You

Fair for You improves people’s lives through responsible lending, helping families access the things they need and supporting them along the way. They believe that affordable finance should be accessible to a wider range of people including many of the 17.5 million people excluded from mainstream finance due to low or fluctuating income or life events.

Fareshare South West

FareShare South West is a charity which used money raised using Social Investment Tax Relief to increase its impact in the local community

Farm Urban

Farm Urban is a social enterprise based in the Baltic Triangle in Liverpool and they operate the city’s first vertical farm whilst also delivering a range of educational and outreach programmes.

FC United of Manchester

FC United of Manchester is a community owned football club which raised money using Social Investment Tax Relief to help build a new stadium.

For Jimmy

For Jimmy creates safe spaces for young people to grow up in, with a strong focus on Lewisham, South East London. It was set up in honour of murdered Lewisham schoolboy Jimmy Mizen.

Freedom Foundation

Freedom Foundation is a Nottingham based social enterprise working to improve children’s physical and mental wellbeing through music, dance, and mentoring.

Furnistore

Furniture is a furniture re-use charity that supports lower income families. It used social investment to purchase a permanent base.

Furniture Resource Centre (FRC Group)

We were delighted to hear from Shaun Doran, CEO FRC Group, at a Let's Talk Good Finance event. Listen to this podcast to learn about their journey to social investment.

Future Yard

Future Yard CIC is a social enterprise established in 2019 to use music as a force for good in Birkenhead and the wider Wirral area, with the ambition to reimagine the role of a community music venue. Alongside a busy programme showcasing exciting new music talent, Future Yard hosts an artist development hub and free skills training programmes to enable young people to pursue careers in the industry. The organisation has also committed to a long-term goal of becoming the first carbon-neutral grassroots music venue in the North of England, and one of the first in the UK.

Giroscope

Giroscope is an award-winning housing charity based in West Hull which renovates empty and derelict properties to provide homes for those in housing need.

Glan Yr Afon (Riverside Pub)

Glan Yr Afon is a valued pub within the community in Pennal, which came under hardship during the Covid-19 pandemic, it is now community-owned after an initiative to save the pub.

Mae Glan yr Afon yn dafarn werthfawr o fewn cymuned Pennal. Bu trwy gyfnod anodd yn ystod pandemig Covid-19, ond mae bellach yn eiddo i'r gymuned ar ôl menter i achub y dafarn.

Gloucestershire Gateway Trust

Gloucestershire Gateway Trust (GGT) is a social and environmental regeneration charity on the largest peripheral social housing estates around the edge of Gloucester by the M5.

Gofal

Gofal is a leading Welsh mental health charity providing a wide range of services to people with mental health problems, supporting their independence, recovery, health and wellbeing. Gofal Enterprises is its wholly owned trading arm.

Golden Lane Housing

Golden Lane Housing, the housing arm of Mencap, used social investment to buy homes for people with a learning disability.

Gorton Monastery

The Gorton Monastery in Manchester was an important part of the community for over 100 years. Derelict for many years, it was saved from ruin by the building preservation trust that still maintains and operates the site to this day.

Grace Enterprises

Grace Enterprises run diverse social enterprises which employ and support people who would otherwise struggle to find and keep a job. Through a commercial cleaning company (Radiant Cleaners), a marquee hire company (Jubilee Events) and a biscuit-making company (Half the Story), they make a positive impact on those individual lives and to society at large.

Greater Change

Greater Change is a Community Interest Company that helps individuals to become free of homelessness.

Greenwich Leisure Limited

Greenwich Leisure Limited, a Community Benefit Society, used a charity bond to help transform new sports facilities as accessible community facilities.

Gro-Organic C.I.C

Gro-Organic are a multiple award-winning social enterprise team based in the West Midlands made up of passionate, local people who together are creating outstanding green spaces whilst investing in local people and the community.

Handcrafted Projects

Handcrafted Projects aims to empower those who have been disadvantaged or faced social exclusion due to crime, alcohol or substance abuse, poor mental or physical health, unemployment, or having experienced abuse or been in the care system. They work with individuals to help them make positive steps to turn their lives around, be part of a community and start to give back.

Headliners UK

Headliners UK used social investment to help them in their mission of empowering young people to tell their stories and care about their community more.

Hemlington Lake Recreation Centre

Tees Valley Community Asset Preservation Trust is a registered charity (CIO) which was established in 2015 in response to local government spending cuts. Its principle aim is to save community centres, sports facilities and village halls from closure by stepping in to offer free advice and support to organisations who feared losing their buildings due to funding cuts.

Hidden Treasures CIC

Hidden Treasure are an organisation driven by a desire to provide better opportunities and facilities to a community that experiences a lot of the challenges of an unequal society. Their centre in Partington offers a welcoming space where children can play and develop and adults can access support, training and somewhere to meet others and relax.

Home Kitchen

Home Kitchen is a not-for-profit restaurant and social impact programme. Developed with top chef Adam Simmonds, they’re serving the finest quality food while transforming the perception of homelessness and making a positive impact on the UK hospitality sector. Their mission is to help socially vulnerable people get out of poverty and into work.

Homebaked Bakery

Homebaked is a co-operative bakery and community land trust, located opposite Liverpool FC’s Anfield stadium, serving their award-winning pies to both football fans and locals alike.

Homes for Good

Homes for Good used social investment to buy houses that it then rents to vulnerable people on lower incomes.

HQ Recording Studio

HQ Recording Studio provides a relaxed, creative environment located in the heart of Leicester city centre. At the beginning of 2019, they completed an extensive refurbishment enabling them to have high quality recording facilities across two rooms, with the latest in cutting edge digital software and hardware.

Hubbub Foundation UK

Hubbub is a London-based environmental charity that engages with corporates and foundations to sponsor research and campaigns, in order to promote understanding and behaviour change to help people cut waste, make clothes last longer, save money and create cleaner spaces to live and work in.

InHouse Records

InHouse Records is the world's first fully functionally record label launched in prison. As a label for change, their mission is to see safer communities, fewer victims of crime and rehabilitation and employment for ex-offenders with a focus on dignity and aspiration. Since launching in September 2017, InHouse's work has engaged hard-to-reach populations both in prisons and through-the-gate, through music-based training programmes for prisoners and ex-offenders. With a focus on using music to improve core competencies and employability skills, its long-term goal is to help graduates lead empowered, fulfilling, and crime-free lives and, ultimately, to reduce re-offending.

Inner City Music

Inner City Music is an award-winning charity that exists to celebrate music and its power to engage, inspire and unify.

IRIE! Dance Theatre

IRIE! dance theatre is the UK's leading dance theatre company delivering creative, educational and artistic activities in African and Caribbean dance. Based in the historic Moonshot Centre in South London, IRIE!'s mission is to support the personal wellbeing and community cohesion of the diverse population in its local area through dance.

The organisation has two distinct but interrelated strands of activities: a wide-ranging community offer across diverse dance styles for young people, adults, families, and older people; and a comprehensive education, training, and professional development offer spanning schools workshops, a degree programme, masterclasses, and residencies for emerging dance artists.

K10

K10 is tackling youth unemployment by providing apprenticeships in the construction industry. It used social investment to professionalise the business and increase sustainability.

Kendal Mountain Events Ltd

Kendal Mountain Events brings thousands of outdoor enthusiasts from across the globe together to share and celebrate the best stories from the world of adventure.

Their vision is to inspire more people to enjoy, respect and represent the mountains, through their annual festival in Kendal, Cumbria, and more recently school engagement programmes.

Kidsgrove Sports Centre Community Group

Kidsgrove Sports Centre Community Group is a CIO set up to save and then re-open Kidsgrove Sports Centre. Following extensive refurbishment the sports centre re-opened in 2022 and is now operated by the charity. Through the charitable community ownership model, every penny spent in the centre gets reinvested. Back into the Centre and back into the community. No shareholders. No profit-making. Just local community facilities for all.

Lighthouse Pedagogy Trust

Lighthouse Pedagogy Trust is a charity that creates children’s homes where children can thrive, with education at the centre of their holistic approach, enabling children in care to have the same opportunities as everyone else.

Lightning Reach

Lightning Reach is a financial support portal which makes it easy for people to find and apply for a wide range of personalised support (including grants, benefits, help with bills and other resources) in one place. The platform can be used by organisations to streamline or enhance the support they offer to vulnerable customers, using innovative technology like open banking and ID verification, or by individuals seeking to improve their financial wellbeing. Lightning Reach has registered >100,000 users and enabled >£10m in funding to individuals. Partners include The Royal British Legion, Lambeth Council, British Gas Energy Trust, TSB and more.

Local Food Links

Local Food Links is a social enterprise providing lunches to primary schools. They used unsecured loans from CAF Venturesome to grow & innovate their organisation.

London Early Years Foundation

London Early Years Foundation (LEYF) used social investment to expand its early years nurseries in London.

London Early Years Foundation

LEYF runs 40 nurseries across 12 London boroughs, delivering high quality Early Years education and care to children aged from birth to five years old.

Mansfield CVS

Mansfield CVS is an infrastructure organisation that has been supporting the community and voluntary sector in Mansfield for over 40 years.

MCVS are a landlord providing serviced offices for tenants and individual room hires for events. They also deliver local authority contracts e.g. public patient engagement CCG, County Council - volunteer co-ordination and Sport England.

Media Cultured

Media Cultured is a social enterprise that tackles issues of racism, radicalisation and misrepresentation through the use of positive role models and clear messages about ‘identity and integration’ within an increasingly multicultural society.

Mentis Tree CIC

Mentis Tree CIC (MTCIC) is a social enterprise providing low-cost therapies across East Anglia. They took on investment from Big Issue Invest after outgrowing their service offices, to buy a place of their own.

MiMe Heuristics CIC (The Wildings)

MiMe Heuristics CIC trading as The Wildings established a new, specialist independent school in Devon for children with Social, Emotional, and Mental Health needs.

Miss Macaroon

Miss Macaroon, founded by CEO Rosie Ginday MBE, sets aside its profits to fund the store's MacsMAD (Macaroons that Make a Difference) programme. Producing over 2.5 million tasty macaroons in 50 different flavours, Miss Macaroon has helped improve the lives of 82 people, all aged 18 - 35 years old, over the past decade.

Moneyline

Moneyline offers access to affordable credit to consumers on low incomes. It used social investment to grow its social business.

Nemi Teas

This #AChangingWorld episode features Pranav Chopra, a social entrepreneur who founded Nemi Teas. This podcast definitely goes down even better with a cup of tea as he talks about how social investment has played a part in his journey and the potential ways to scale up.

Nottingham Counselling

Nottingham Counselling Service (NCS) is a long-standing charity specialising in working long-term with people who present complex and enduring problems, such as anxiety, depression and abuse.

Old Spike Roastery

Old Spike Roastery source, roast and pack some of the finest coffee available whilst offering meaningful employment to those affected by homelessness. Here's how a £60,000 loan from CAF Venturesome is helping us deliver our mission.

Omnis Circumvado CiC

Omnis Circumvado CIC is a specialist sports coaching company dedicated to providing inclusive and adapted physical activity opportunities to people of all ages with complex needs.

Oomph!

Oomph! is helping older people stay healthy by running specialist exercise classes in care homes across the UK. It used social investment to grow its social business.

Outside the Box

Outside the Box Café is an inclusive community café based in Ilkley, Bradford. Their mission is to enable young people and adults who have learning disabilities to have more fulfilled, independent and healthier lives.

P.A.C.E

Promote Ability Community Enterprise CIC (P.A.C.E) delivers affordable services and housing for disadvantaged people in Derby and Derbyshire. To support this agenda, they offer a range of other services to the public and private sector; these include supported housing, a craft centre, community support and a café.

Paces Sheffield

Paces is a leading charity for children and adults with Cerebral Palsy and other neurological disorders. They used social investment to refurbish and fit out their new premises, making it fit for purpose.

Portpatrick Harbour

Portpatrick Community Benefit Society used Social Investment Tax Relief to raise money to save the local habour.

Projekts Manchester

Projekts MCR is a skatepark and community development organisation in Manchester that provides a space for young people and their families to enjoy skateboarding, meet and connect with others, and access wider social support. It’s one of the largest outdoor, concrete skateparks in the UK.

Prom Ally CIC

Prom Ally offers the free loan of prom dresses and suits to school children, sixth form students and college students who otherwise couldn't afford one. All outfits are used and either purchased from charity shops or donated directly. Prom Ally has helped hundreds of girls since it began and has recently opened up to boys too offering suits in addition to the dresses.

Proper Job Theatre

Proper Job Theatre is a social enterprise creating meaningful work opportunities through teaching drama workshops.

Readipop

Established in 1998, Readipop is an innovative music and arts charity with a strong reputation for inspirational, engaging arts projects that make a positive difference in people's lives.

They provide access to music for vulnerable young people from hard-to-reach areas, including young offenders, the long-term unemployed, Special Educational Needs students, individuals from pupil referral units, and those who are not able to access conventional education. Their music leaders empower young people to learn and improve their music skills; helping them gain confidence in their chosen area and achieve their own goals while improving their emotional and social wellbeing. Readipop work closely with a whole host of other locally based community music programmes and projects to maximise reach and impact.

Rene House CIC

Rene House is a small social enterprise based in Nottingham, they provide supported accommodation for homeless and vulnerable adults and families. They currently manage a portfolio of 7 properties comprising of 18 units. Rene House aims to create a sustainable stepping-stone service for individuals and families that need support to get back on their feet.

Resultery Projects Cymru

Resultery Projects Cymru is a sports facility in Bettws. They provide a space for the community to enjoy a range of activities from sports clubs, dance to community gardening.

Cyfleuster chwaraeon ym Metws yw Resultery Projects Cymru. Maen nhw’n cynnig lle i’r gymuned wneud amrywiaeth o weithgareddau, o glybiau chwaraeon a dawns i arddio cymunedol.

Rose Tinted Financial Services C.I.C

Rose Tinted Financial Services offers Personal Financial Support and Mental Wellbeing Services for people from all backgrounds and ages who are in debt, just live from paycheck to paycheck and are struggling to take control over their financial situation provoking a negative impact on their mental health.

Royal Society for Blind Children

RSBC provides a range of services in London and across England and Wales for blind and partially sighted children and young people, their families, and the professionals who work alongside them.

Second Shot Coffee

When Julius Ibrahim became increasingly more interested in tackling homelessness, he opened Second Shot Coffee, a social enterprise café in East London.

Social AdVentures

Social adVentures is dedicated to helping people and communities in Greater Manchester live healthier and happier lives, by providing a variety of interventions designed to help people take control of their lifestyle and to be less reliant on more serious intervention in the future.

Southmead Development Trust

The Southmead Development Trust exists to serve the community of Southmead by primarily running the Southmead Youth Centre and the Greenway Centre. It used social investment to install solar panels.

Special iApps C.I.C.

At Special iApps, we develop educational apps to support children with special educational needs, including autism and Down syndrome. We took on social investment, in the form of blended finance (loan and grant), from Northstar Ventures to help develop our work.

St Mungo's Broadway

The Real Lettings Property Fund, run by Resonance in partnership with St Mungo’s Broadway is using social investment to buy properties to address homelessness in London.

Social Impact Bonds, supported by social investment from CAF Venturesome, Big Issue Invest and Resonance, enables us to work intensively and creatively with people so they can finally leave homelessness behind for good.

Sutton Community Farm

Sutton Community Farm is a community-owned farm in South London growing vegetables under organic principles.

Tafarn yr Heliwr

Tafarn Yr Heliwr is a Community-Benefit Society based in Nefyn, Gwynedd, Wales and was established in order to raise money and re-open the village pub as a not-for-profit community-owned business.

Teens and Toddlers

Teens and Toddlers is a Social Impact Bond working with young people in the North West. It is part of the Department for Work and Pensions' Innovation Fund.

The Bike Project

The Bike Project are a charity that takes in second-hand bikes, refurbishes them and donates them to refugees and asylum seekers in the UK. The bikes help them to access food banks and other critical services as well as improving their general wellbeing.

The Craufurd Arms

It was great to hear from Mark Newcombe, co-founder of the Craufurd Arms, a community pub in Slough. Listen to this podcast as part of our #AChangingWorld series and we explore how social investment has affected organisations during the lockdown and the opportunities it could now present.

The Energy Training Academy

The Energy Training Academy (ETA) is a community interest company that specialises in providing high-quality training and education in the gas and renewables industry. ETA works with young people, veterans, and those from disadvantaged backgrounds to ensure they gain valuable skills for the green energy transition.

The Freedom Bakery

Freedom Bakery raised investment from seven investors using the Social Investment Tax Relief to grow their prison-based social enterprise.

The Ledge Inverness

The Ledge is a registered Scottish charity dedicated to changing lives for the better via the medium of climbing. Climbing helps build confidence, teamwork, and resilience. It helps develop diverse skill sets, improves focus, and increases co-ordination. On top of all that, it’s a whole heap of fun!

The Skill Mill

The Skill Mill are social enterprise providing employment for young ex–offenders in watercourse and horticulture services.

The Spotted Cow

The Spotted Cow is a community hub that offers a bar, restaurant, Post Office and B&B under one roof.

The Urban Factory

The Urban Factory is 13500 square foot manufacturing unit that was upgraded to provide the regions first dedicated training facility for cheerleading, tumbling and parkour.

Think2Speak

It was wonderful to hear from Lizzie Jordan, founder of social enterprise Think2Speak. Listen to this podcast as part of our #AChangingWorld series and we explore how social investment has affected organisations during the lockdown and the opportunities it could now present.

Third Space Learning

Third Space Learning is using technology to tackle underacheivement in maths. It used social investment to grow its social business.

TLC: Talk Listen Change

TLC: Talk, Listen, Change is a relationships charity that has supported people in the North of England for over 40 years. Their aim is to ensure everyone within their community benefits from good emotional wellbeing, and they believe the key to this is maintaining safe, healthy and happy relationships.

Together TV

Together TV inspires social change through entertaining content – by showing real-life stories, activities and social issues that promote participation in national campaigns and causes. By encouraging people to get involved in causes and initiatives that offer relevant, practical and achievable things to do, the channel promotes healthier lifestyles, improved mental wellbeing and increased social connections amongst its viewers.

Togetherall (formerly Big White Wall)

Togetherall (formerly Big White Wall) is a digital mental health and wellbeing service, which used social investment to scale their social business.

ToolShed

ToolShed is a social enterprise helping young people start their career in construction. When a combination of people, influences and place comes together it can impact our lives in a special way. I think Toolshed is like this and will help change the lives of many for good.

Trees for Life

Trees for Life is home to the first (known) rewilding centre in the UK and their vision is of a revitalised wild forest in the Highlands of Scotland, providing space for wildlife to flourish and communities to thrive.

Trust Links

Trust Links is a local independent charity for wellbeing and mental health based in South East Essex. Here's how a secured loan from Charity Bank helped them take on a community asset to grow their services.

Tumble Gymnastics & Activity Centre

Tumble Gymnastics and Activity Centre is a facility that offers physical activity and wellbeing for everyone regardless of age and ability in a family fun environment creating a unique experience. Focused on gymnastics, their social mission is to encourage and support young people and adults who are currently physically inactive to increase their activity levels to improve their physical and mental health.

Valley Heritage

Valley Heritage is a not-for-profit organisation established in 2015. It seeks creative approaches to bring historic buildings back into use while simultaneously supporting the growth and development of the local community.

Vinelife Church

Vinelife Church is a faith-based organisation. We took on a secured loan to diversify their income and carry on serving their community.

We Are Juno

We are Juno is a not-for-profit children’s residential service, creating a sustainable alternative to profit-driven models that dominate the children’s residential landscape.

Wellington Orbit

The Clifton Community Arts Centre Ltd (CCAC Ltd), trading as Wellington Orbit, is a social enterprise based in Telford. They took on approximately £75,000 in SITR loans and shares from local people. Here's how social investment is helping them provide art and cultural facilities in the town of Wellington, Shropshire.

Wolverton Community Energy

Wolverton Community Energy are based in Milton Keynes. They develop and manage community-owned solar PV and supply greener, cheaper solar energy to local businesses, the majority of which are charities and social enterprises. In addition, they run projects which help to improve energy efficiency within their community. This includes the Home Energy MK programme, supporting homeowners wishing to stop heat loss from their homes and cut energy costs.

YMCA Robin Hood Group

YMCA Robin Hood Group provide a range of frontline services across Greater Nottingham, York and East Riding, plus Newark & Sherwood, to encourage young people to belong, contribute and thrive. This includes residential settled care homes, supported housing and numerous support programmes. Explore how they used social investment to grow and innovate their service offering.

Young People Matter

Young People Matter (YPM) is an award winning charity and community action group bringing together people of all ages and backgrounds to nurture children’s potential, promote healthy living and develop a greater sense of social responsibility.

Your Own Place CIC

Rebecca White, CEO of Your Own Place CIC talking about her organisations’ experience of taking on social investment from Sumerian Partners, just before the COVID-19 hit. Listen to hear more about her patient equity investment deal that has allowed Your Own Place to scale up activity and employ a new member of the team.

Zion Community Cafe

Zion Community Cafe is well-loved Cafe in Bristol that runs a large variety of community events, children’s groups, support groups, ticketed events and provides spaces to hire for meetings, groups and private events. They used Community Shares and the Community Ownership Fund (COF) to save their venue.

Citizen Coaching & Counselling

Citizen Coaching & Counselling provides timely, jargon-free coaching and counselling to young people and adults in Birmingham with a friendly professional approach. We provide a choice of talking therapies, most of which are free to access, delivered by a team of 45 specialist qualified counsellors and psychotherapists.