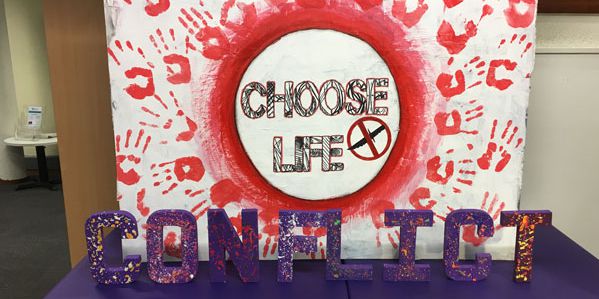

Creative Optimistic Visions (COV) is an award-winning Community Interest Company providing alternative education, training, universal youth provision, consultancy and mentoring services through the lens of the Protective Behaviours Process (PBs)

ToolShed is a social enterprise helping young people start their career in construction. When a combination of people, influences and place comes together it can impact our lives in a special way. I think Toolshed is like this and will help change the lives of many for good.

We were delighted to hear from Shaun Doran, CEO FRC Group, at a Let's Talk Good Finance event. Listen to this podcast to learn about their journey to social investment.

When Julius Ibrahim became increasingly more interested in tackling homelessness, he opened Second Shot Coffee, a social enterprise café in East London.

We are a CIC based in Kent, supporting people with learning difficulties to speak up, make choices and become powerful and influential. We are people with and without learning difficulties and/or autism, working and learning together.

The Gorton Monastery in Manchester was an important part of the community for over 100 years. Derelict for many years, it was saved from ruin by the building preservation trust that still maintains and operates the site to this day.

Community Campus 87 is a Community Benefit Society based in Tees Valley, Middlesbrough. We provide affordable housing, emotional & practical support, & training opportunities to over 200 people each week.

Vinelife Church is a faith-based organisation. We took on a secured loan to diversify their income and carry on serving their community.

At Special iApps, we develop educational apps to support children with special educational needs, including autism and Down syndrome. We took on social investment, in the form of blended finance (loan and grant), from Northstar Ventures to help develop our work.

The Clifton Community Arts Centre Ltd (CCAC Ltd), trading as Wellington Orbit, is a social enterprise based in Telford. They took on approximately £75,000 in SITR loans and shares from local people. Here's how social investment is helping them provide art and cultural facilities in the town of Wellington, Shropshire.

Trust Links is a local independent charity for wellbeing and mental health based in South East Essex. Here's how a secured loan from Charity Bank helped them take on a community asset to grow their services.

Mentis Tree CIC (MTCIC) is a social enterprise providing low-cost therapies across East Anglia. They took on investment from Big Issue Invest after outgrowing their service offices, to buy a place of their own.