If you’re currently considering social investment then we really encourage you to ask investors about their average cost of lending. Social investors don't all do the same thing and they don’t all lend the same type of money.

Since January, we’ve been sharing 7 lessons to help you navigate the world of social investment. This post is lesson five in the series, looking at the cost of social investment & why it isn’t always cheaper when it’s social.

Social investment can be a risky business…

When a loan or investment is being made, investors first consider how risky the investment is. From this, they will consider what terms to offer. Risk assessment is crucial in the early stages of an investment because often social investors will lend where mainstream lenders will not. A large reason for this is because often their money comes from different places.

Where do social investors get their money from?

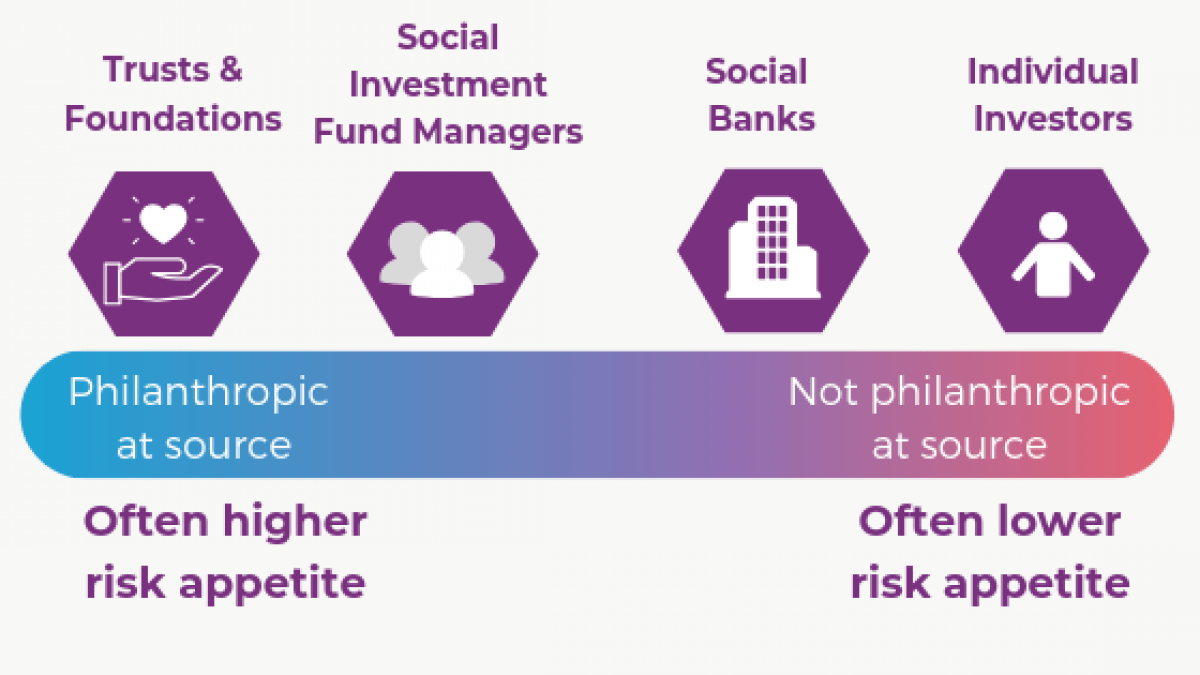

The source of a social investor's capital can often denote the amount of risk they can take. So have a look at where specific social investors get their money from. Firstly, this can better help you align your mission with theirs; you can check if you truly have the same goals and ethos. Also, it could tell you why investment from them costs a certain amount.

For example, let’s take a look at an investor/fund manager who specialises in a lower risk form of lending. Those with a lower risk tend to have their money from deposits from other charities, trusts, foundations or individual retail investors (like you or us). So they may be most likely to offer a secured loan. The cheapest form of commercial finance is actually often a secured loan. However, it must be secured against an asset.

Now let's look at those who specialise in higher risk forms of lending. Often, their money is philanthropic at source. As their capital has largely been given to them benevolently, they can can make adjustments in price and do higher risk lending with unsecured loans.

You can use this graph as a very basic guide to risk levels. However be sure to also ask individual investors as our guide is not definitive!

Remember, even if they're prepared to take a high risk or offer an unsecured loan, they do still need the money back! It's useful to think of it this way: when you pay it back with interest that money can be put towards funding another great organisation. Then their repayment can go towards funds for another, etc.

Ultimately, the cost depends on the investor

Ask yourself & them:

- What are their motivations for investing?

- What sort of risk appetite do they have?

- What are their return expectations? Bear in mind that many social investors will balance the expected risk with the expected social impact.

Risk is all about taking a balanced approach: some will pay more; some will pay less and some will be lost.

Find 80 social investors and advisers here.

More in the 7 lessons in social investment series

Removing Ideas That Social Investment Is Grant Money

Here's Why Social Impact Matters

Why Taking On Social Investment Is About Much More Than The Money

6 Tips to Build Honest and Strong Relationships with Investors

How much does social investment cost?

4 Steps to Prepare for Due Diligence

Read the article that inspired the series here.

Emily Parrett

Digital Marketing & Communications Officer, Good Finance