Earlier this year, the 6,000th user completed Good Finance’s ‘Is It Right For Us’ tool, which helps charities and social enterprises to determine whether social investment is worth exploring. In this post, we explore what we can learn from these results and how it challenges our assumptions of the typical Good Finance User.

What’s the Tool?

Our diagnostic tool takes just 2-3 minutes and asks questions about your organisation and your financial needs to help you understand if social investment is a viable option. If so, it will direct you to the types of social investment that might be suitable and some recommendations for next steps. If not, it will signpost you to organisations and resources that will be able to help you to become ready for investment.

Upon our 6,000th completion of the tool, we took a closer look at the insights provided and what this can tell us about what social enterprises, charities and community organisations are currently looking for from social investment.

Of these completions, we anonymised the data, removed any repeats and analysed the results. Here’s six key findings we want to share with our users, key stakeholders, the sector and beyond.

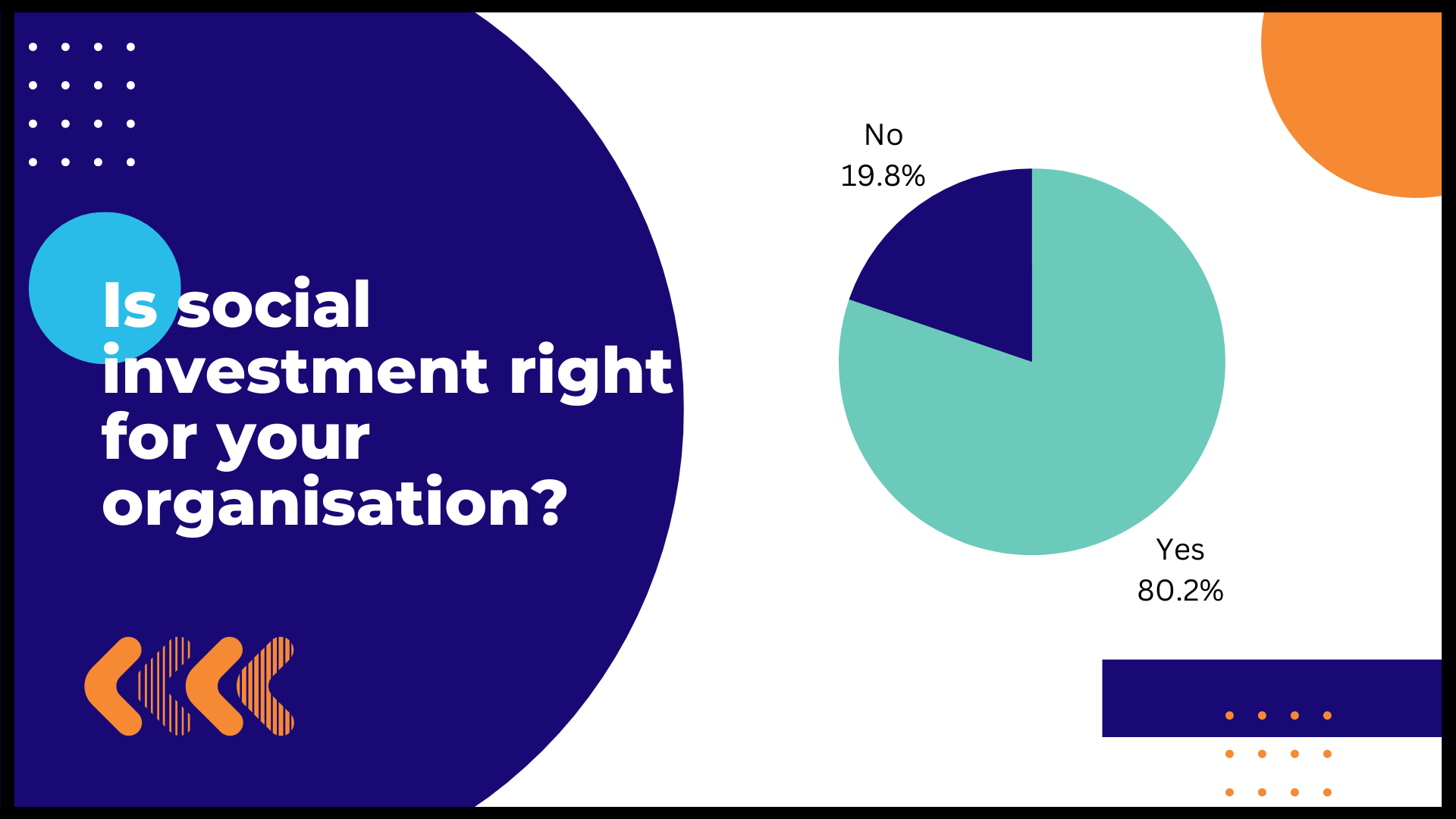

#1 Four in Five organisations completing the tool found that Social Investment was right for them.

Our data shows that for 80% of users of this tool social investment was a possible option, and just 20% were found to have been unsuitable for social investment, based on the answers submitted.

In addition to this, 80% of organisations completing the tool also knew how they were going to repay the loan. These results suggest that users are accessing Good Finance resources with a solid understanding of repayable finance and crucially, how they plan to repay a potential loan.

This challenges the assumption that repayable finance is only for a very small segment of the sector and suggests a more enterprising approach to organisational income altogether. That said, it’s important to remember that social investment isn’t right for everyone, and – if you’re not one of our 6,000+ respondents – this resource is a great place to start!

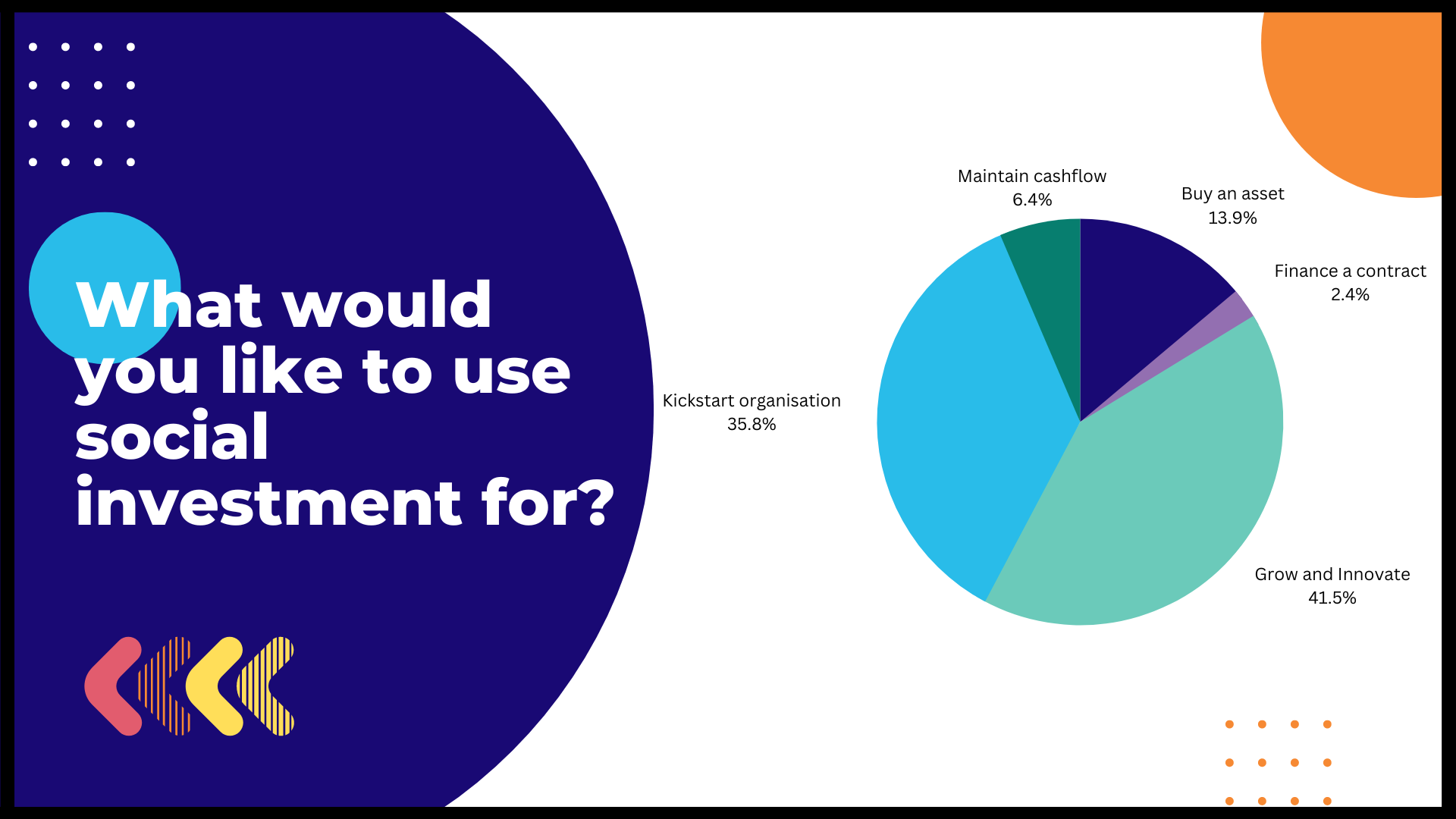

#2 Of all the organisations completing our tool, 41% are exploring social investment to grow and innovate their operations

Growth and innovation was highlighted as the number one reason for seeking social investment, closely followed by ‘to kickstart an organisation’. Together, they were responsible for the lion share of our tool completions, with nearly 80% of respondents selecting one of these options.

Interestingly, this is in contrast to the findings of the State of Social Enterprise: No Going Back findings from 2021, which reported 55% of their survey respondents were using social investment to maintain cash flow, compared to just 6.4% of our tool completions. This suggests Good Finance users are turning to social investment to finance an action, like scale or development, rather than to maintain business-as-usual operations.

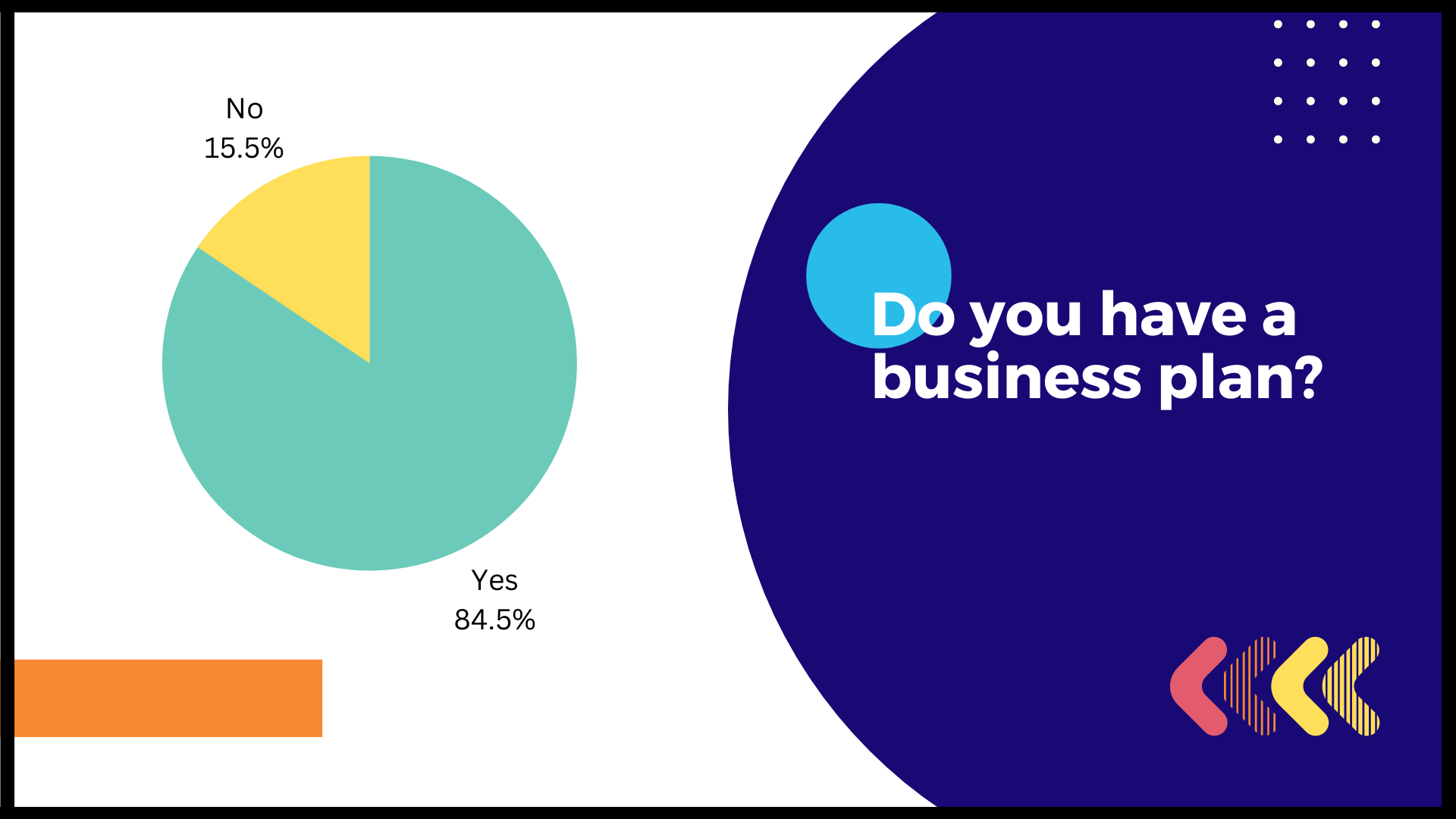

#3 A significant majority of organisations already have a business plan for their Social Enterprise or Charity

Interestingly, 85% of organisations highlighted that they already have a business plan when completing the tool, suggesting that many are further along in their journey to social investment or other types of finance and funding than we originally may have expected the average user for this particular tool to be.

Business planning is an essential aspect of any organisation that may seek social investment in the future, and social enterprises and charities will need to know their business plan back-to-front ahead of the Due Diligence process. More resources can be found on the Business Planning section of our Pre-investment Support Hub.

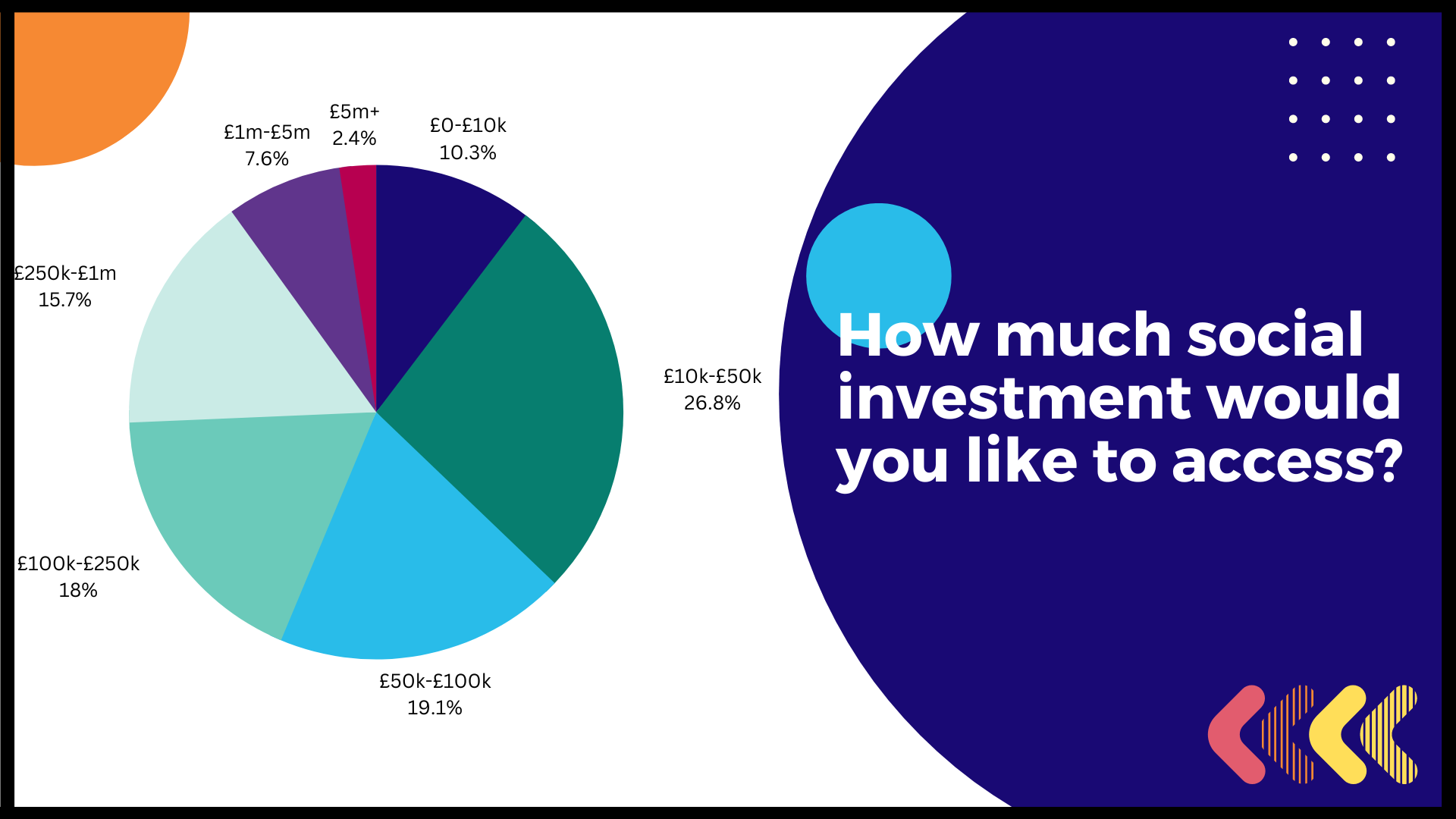

#4 A quarter of those completing the tool were looking to secure between £10,000 and £50,000

With 26.2%, £10,000-£50,000 was the most popular amount that our users are looking to secure. This confirms existing research that £50,000 is the average requirement for a first-time social investment loan.

That said, these figures confirm that 25% of organisations were looking for more than £250,000, with 10% looking for more than £1m in total. In terms of sample size, that’s over 500 organisations looking to secure seven-figure loans, again challenging the assumption that the majority of Good Finance users are smaller organisations.

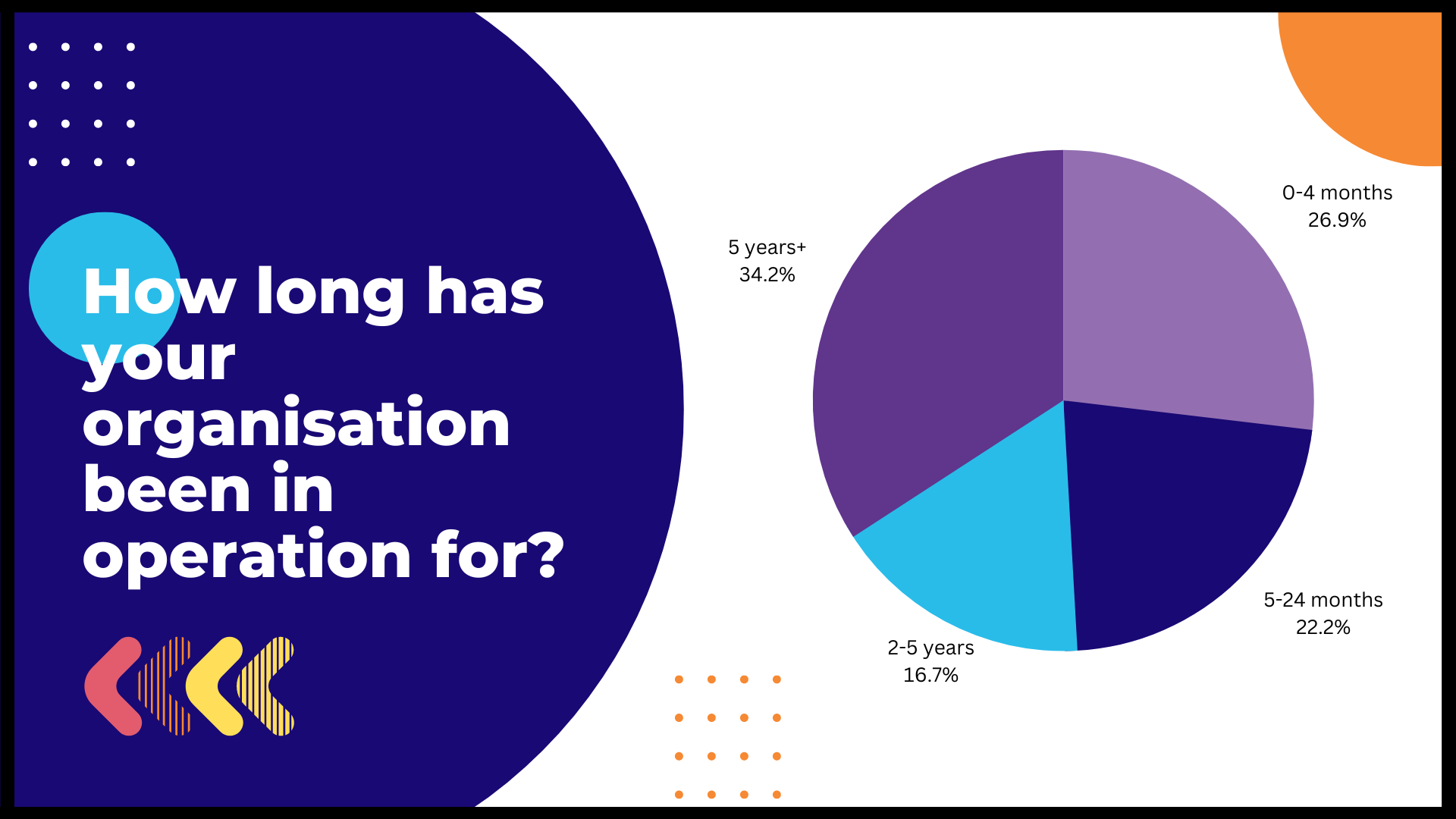

#5 Over a third of organisations completing our tool have been in operation for 5+ years

The most popular answer selected to the question: “How long has your organisation been in operation for?” was 5+ years, with 34.2%. Again, this challenges the assumption that the average Good Finance user is in the kick-start stage of their organisation.

Instead, these results suggest that well-established charities and social enterprises are looking to diversify their income; potentially a direct effect of the diminishing availability and ease of access to grants and other more traditional forms of funding.

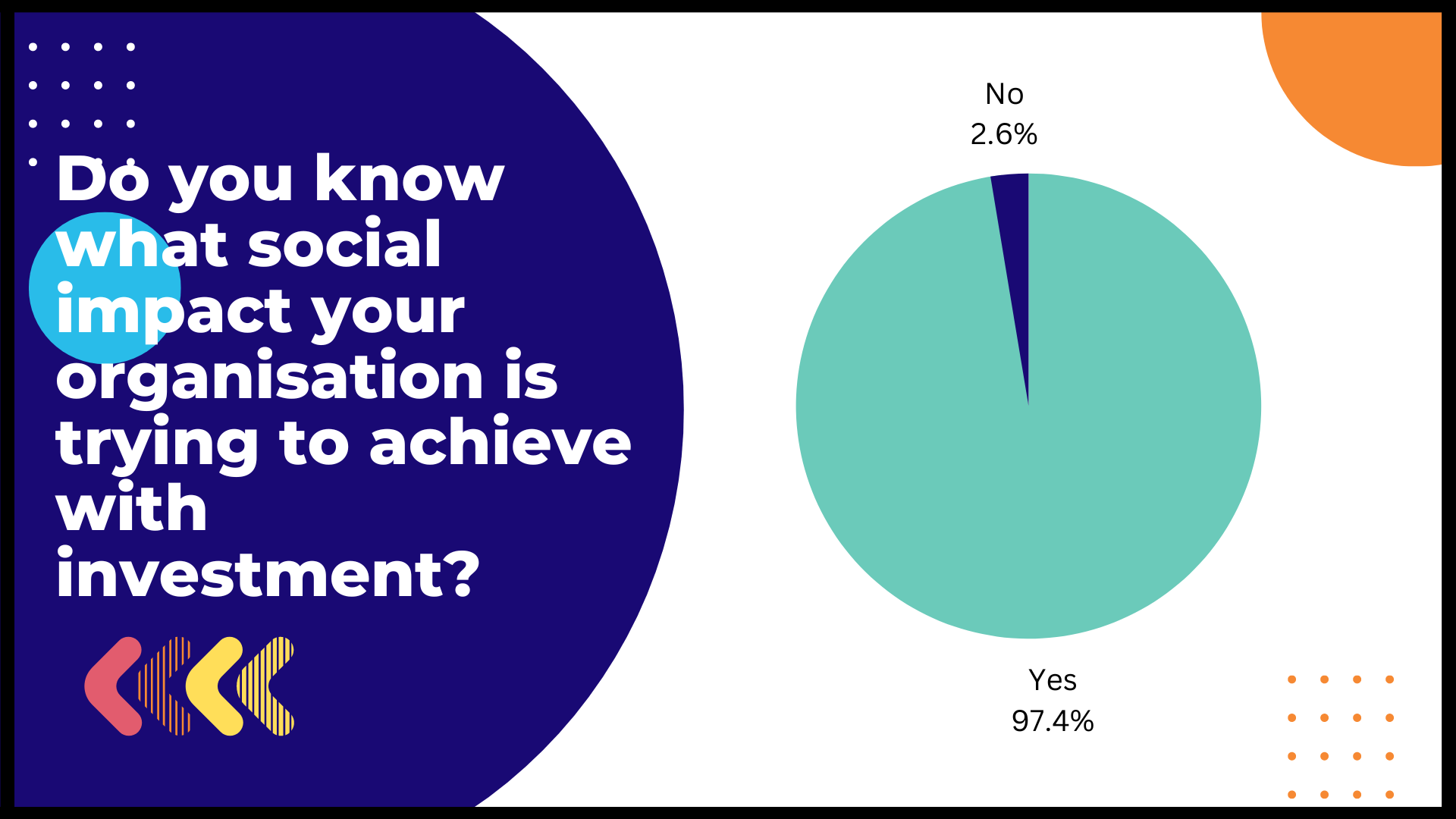

#6 It’s All About Impact: a whopping 97.4% of respondents know what social impact they are trying to achieve with social investment

We’ve said it before and we’ll say it again: it’s all about impact. An overwhelming majority of organisations completing this tool knew exactly what social impact they were hoping to create for the communities they serve.

Perhaps confirming what we already knew about the unfaltering passion, dedication and determination in social enterprises and charities tackling social issues and delivering real change for their beneficiaries. To learn more about measuring that social impact, please check out our Outcomes Matrix tool.

To view the full analysis of these results, please check out: Is It Right For Us – Analysis.

As a user-led platform, we’re keen to understand more about our users, what their current challenges are and how we can create useful content to help them to navigate the social investment space. If you’d like to chat to the team about other data / insights we collect, please don’t hesitate to get in touch.