The landscape of finance for social enterprise has been significantly affected by Covid-19.

It’s hard to remember that a year ago we didn’t talk about bubbles and tiers, CIBLS and BBLs. The landscape of finance for social enterprise has been significantly affected by Covid-19. This last year Social Enterprise UK’s Social Enterprise Advisory Panel has been tracking social enterprise perceptions of the changing ecosystem through a series of online surveys.

The initial panic of lockdown last March was slowed by the announcement of government support schemes, which offered varying degrees of relief to social enterprise. Whilst the furlough scheme helped many, other loan and grant provisions were often exclusionary, particularly in their initial forms.

In this post we explore…

Looking Back at Low Interest Rate Loans

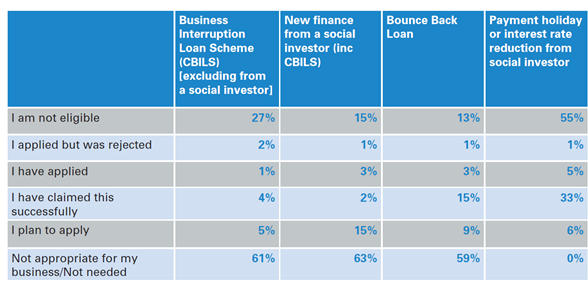

An important part of the Government financial support package to business was low interest rate loans. SEUK’s Social Enterprise Advisory Panel found that Bounce Back Loans (BBLs) were more likely to have been sought (and secured) by social enterprises than other forms of repayable finance, with CBILS proving less popular – partly due to the stricter criteria applied, partly because BBLs offered a low capped interest rate.

Have you engaged with the following support measures? (June 2020)

A specific issue with bank accounts was identified – around 10% of social enterprises bank with providers other than the 20 accredited lenders for the BBL scheme and a number struggled to secure the necessary bank accounts with accredited lenders to access funds. This is both quite a specific issue – but indicative of the gap in financial provision for social enterprise in ‘mainstream’ banking.

The Development of Grant Funding

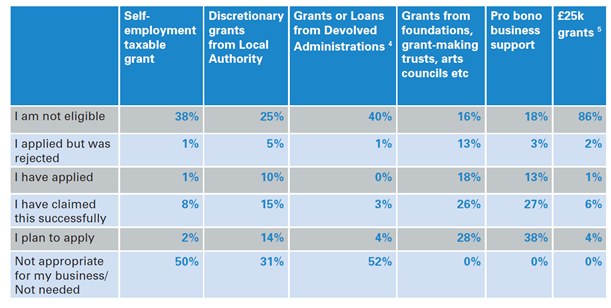

Grant funding was also made available. A concern early on in the COVID-19 crisis from a social enterprise perspective was the poorly-targeted nature of business grants. Over £12bn in grants were assigned to the private sector, but few social enterprises were able to access these because they are not claiming the right tax reliefs or did not fall into the categories of eligible businesses. Guidance for the £617m of additional business grants made available in May 2020 made clear that it was open to all types of business and gave local authorities more discretion about the support that they could give to social enterprises and other forms of socially valuable business.

Grants from foundations and pro bono business support were popular for social enterprises and yielded comparative success, although their application processes – and the complexity of finding and applying for multiple sources, given individual application rates of rejection, did not make this an easy option.

Have you engaged with the following support measures? (June 2020)

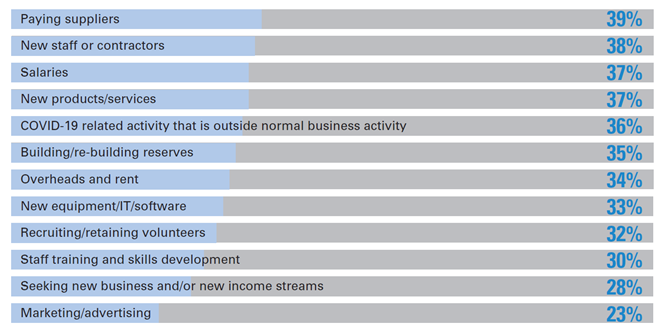

The Social Enterprise Advisory Panel explored how social enterprises are using new income – demonstrating that in contrast with concerns of fraud in the traditional business sector, social enterprises were spending this income productively. 75% of those that responded are either using funds to pay salaries, to pay new staff, or both and over a third of expenditure was on COVID-19 related activity that is outside normal business activity. No organisations report that building/re-building reserves is the only use of the money, with all citing at least two other forms of expenditure.

If you've received new income from grants, returnable finance, Government support schemes or other sources recently, what are you spending it on? (July 2020)

Repayable Finance Trends

Repayable finance hasn’t (ever) been appropriate for all – but there is a question about the influence of CBILS and BBLs on short and medium term appetite for repayable finance. And in the longer term, the need for social investors to offer loans with lower interest rates. Is now the moment for the social investment sector to fundamentally re-visit its terms of lending?

Change has already started. Growing evidence of the short-comings of traditional debt finance in providing for the social enterprise sector have been compounded and accelerated by both the COVID crisis and the increased focus on how some people are systematically excluded from finance because of their racial background - highlighted by Black Lives Matter protests in the summer of 2020 and subsequent sector-wide soul-searching on inclusion, diversity and equity more widely. This resulted in targeted fund programmes – but also consideration of how to make generic funding and finance less exclusive.

There is increased emphasis by social investors on quasi-equity/equity like finance and ‘patient capital' – finance provided on terms requiring slower and lower rate return/smaller ownership stakes which acknowledge the requirement for social enterprises to build strong foundations rather than make fast financial returns for investors.

Certainly the high application rate for available grant funding from the sector, and ongoing identification of lack of sufficient grant funding as a barrier, indicates appetite for alternatives to fully repayable finance. 83% of social enterprises surveyed in June 2020 said they needed grants in the next 2-3 months.

In January 2021, several social enterprises indicated concern about a funding cliff at the end of the current financial year – especially given that several targeted funds have short spend-term requirements. Lack of clarity about the Shared Prosperity Fund was cited as a particular worry.

What does the future look like?

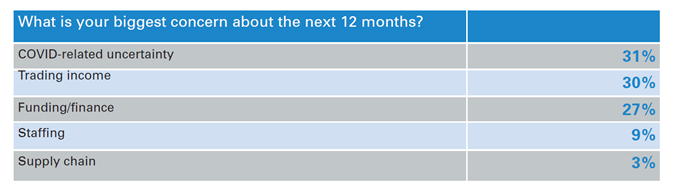

Funding and finance remains an important issue for almost a third of social enterprises. Ongoing COVID-related uncertainty is the prominent concern for the sector (Jan 2021), and this is likely to influence capacity for borrowing. At the moment the sector continues to look resilient – 80% of social enterprises have cashflow for at least 2-3 months (Jan 2021) and 65% expect to maintain a similar position or grow over the next 3-6 months (Feb 2021).

The combination of the end of government support programmes, lifting of COVID restrictions, continuing innovation to address inclusion of marginalised groups and experimenting with new finance structures make for at least an interesting year for investment in the sector.

By the end of 2021, maybe vocabulary we want to become mainstream includes patient capital and inclusion-first investment.

Emily Darko is the Director of Research at Social Enterprise UK. You can follow her on Twitter via Emily_Darko.